Investing in real estate with Propsharing

If Propsharing is a new term for you, you’re not alone. Before we get into the ins and outs of Propsharing, let’s talk about how most real estate investment is done today. Feel free to jump ahead if you’re already in the know.

Real estate investment has traditionally been possible in two ways:

Full ownership: Purchasing full ownership in a home or investment property as an individual or with a small group of partners

REIT: Investing in a portfolio of properties through a Real Estate Investment Trust (REIT)

Full ownership

Full ownership is the traditional approach to property ownership; buy a property to live in or rent out. By investing in a property you gain access to appreciation over time, and cash flow from rental income (if you’re renting it to tenants).

Evaluating, and purchasing properties is typically highly work and cost-intensive, with high upfront costs, taxes, fees, paperwork, and the underlying knowledge necessary to properly evaluate the return potential of a given property.

Owning property involves the costs of maintenance and repairs, and in the case of rentals: managing tenants, and filling vacancies.

Since real estate has appreciated in value for a long time (about 6% per year for the last 15 years), property investment is typically seen as a good way to generate reliable returns. Plus, you gain access to the magic of leverage.

Leverage

What attracts many investors to real estate is access to low-cost debt; or leverage. Leverage is the concept of using other people’s money. In real estate, leverage means using bank debt to reduce the amount of capital that the investor needs to come up with in order to make an acquisition.

Banks offer this low-cost debt in the form of a mortgage. Since most people don’t have a couple hundred thousand dollars lying around, mortgages make assets that would otherwise be unattainable available to more people. So, instead of paying $500,000 upfront for a property, you can put down $50,000, and pay for the rest over the next 20 or 30 years.

The ability to make your money go farther makes the upside of real estate even more attractive to investors.

Here’s an example with oversimplified hypothetical numbers to make the math easier:

By putting down only 10% of the value of the property, you make 5x the return as if you put down the full amount.

Risks of leverage

Taking on debt introduces risk. The amount of debt, market conditions, your personal financial situation, and risk appetite all play into how you should approach taking on debt. A mortgage is a commitment to make monthly payments for a long period of time (usually 20-30 years).

In other words, when you use other people’s money, you have to pay it back.

This may make it more difficult to handle lifestyle changes, like a career break or change in direction, a spontaneous move, or anything else that may result in generating less income than you were before.

Mortgage interest rates are also tied to the market, which means your monthly payments may fluctuate with the market. This makes it easy to overextend your financial means when rates are low and end up locked into an unaffordable mortgage when rates increase.

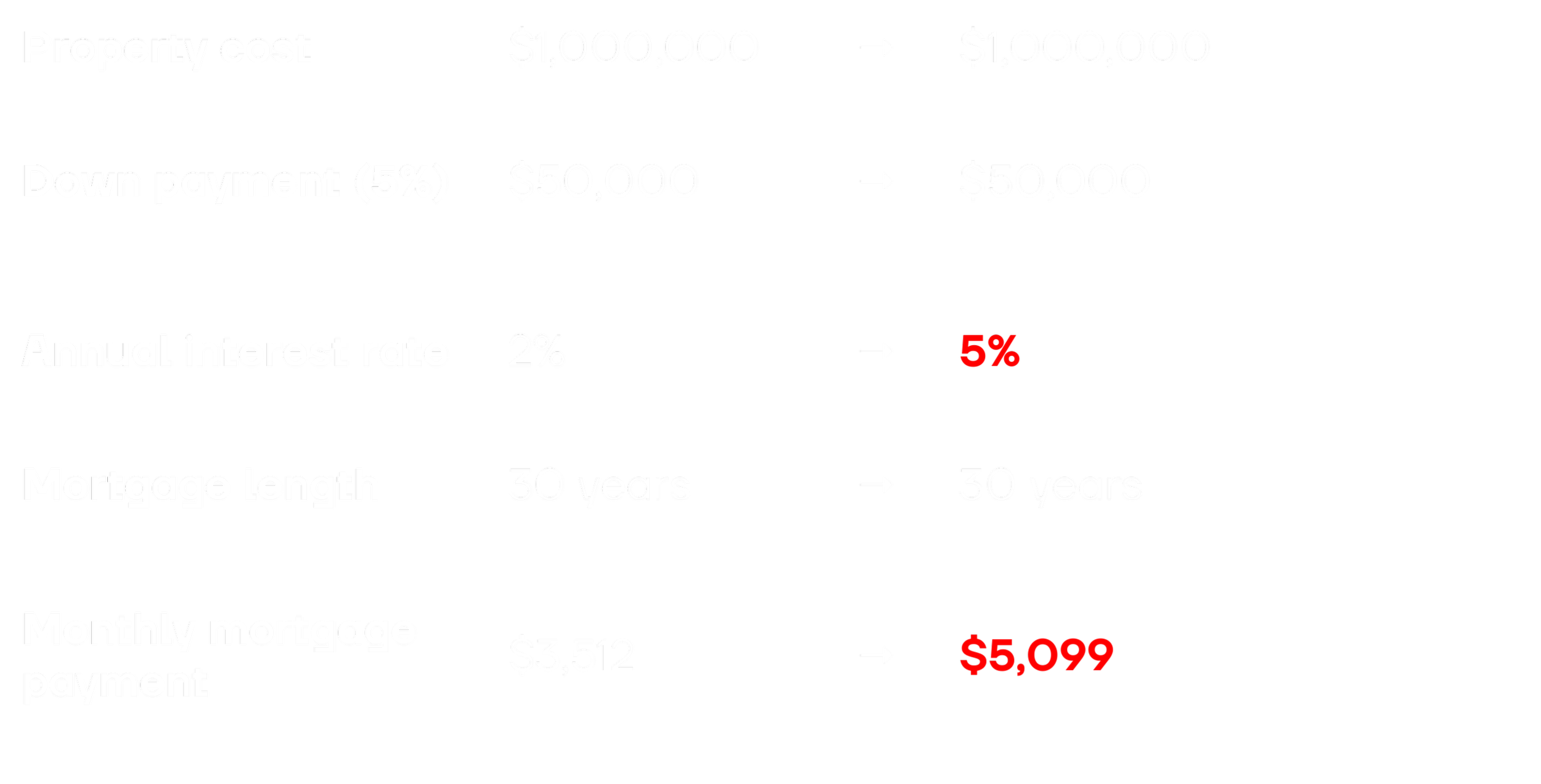

Here’s an example:

In this oversimplified hypothetical example, your monthly mortgage payment would be about $3,512. This excludes other fees that go along with buying a property, like welcome tax, property tax, brokerage fees etc.

Now, let’s say the economy takes a bit of a turn and the interest rate goes up to 5%.

Your new monthly payment would be: $5,099

That’s $1,500 more every single month from an increase of only 3%!

Leverage summary

Leverage can be a powerful tool to gain access to investment opportunities that would otherwise be prohibitively costly. When used correctly, it can be an incredible tool to grow wealth. But, leverage also comes with significant risks that should be thoroughly evaluated prior to making a decision.

While the upside may not be as attractive, paying for an asset upfront removes the risk associated with being in debt. For many people, this is an easy trade-off to make for the reduced stress that comes with being debt-free.

*Purchasing a property is a very large purchase that carries risk regardless of the investment strategy.

There are advantages and disadvantages to both investment strategies, and it’s important to do your research and evaluate what makes the most sense for you.

REITs

Real Estate Investment Trusts (REITs) allow individuals to invest in portfolios of income-producing real estate. REITs are companies that own and operate assets, like, apartments, shopping malls, warehouses, and hotels.

REITs make it easier for individuals to earn a share of the income produced through real estate ownership without having to acquire the underlying properties themselves.

REITs make it simpler to gain exposure to real estate by reducing the upfront costs and simplifying the purchase process.

In this way, REITs are similar to mutual funds, or stocks.

While REITs offer an easier way to diversify your portfolio into real estate, there are some downsides associated with these types of investments compared to direct property ownership.

Lack of transparency: REITs are typically made up of portfolios of assets. It can be difficult or impossible to assess the performance of individual assets within the portfolio and evaluate whether costs are being optimized.

Low flexibility: Unlike direct property ownership, investors in REITs have limited control over property selection and management decisions. The lack of flexibility may be a disadvantage for those who prefer hands-on control of their real estate investments.

Propsharing

Propsharing is the revolutionary new way that people are investing in real estate. Properties are split into 100,000 units of ownership and offered for sale. It makes investing in rental properties as easy as buying shares on the stock market.

Once you invest, you’ll receive a portion of the income that the property generates from rental income as well as appreciation over time.

Propsharing combines the advantages of full ownership, like transparency into performance and costs of the specific property, reliable appreciation, rental income, and low-cost leverage with the advantages of investing in stocks, bonds, or REITs, like diversification, and flexibility.

By lowering barriers and empowering individuals, it allows investors to grow wealth in real estate whether they own their home or not.

Advantages:

Access: Propsharing opens up the real estate market to those who might not have the capital for full ownership, opening access to the wealth-building potential of real estate allowing at a lower cost.

Flexibility: Propsharing delivers the financial advantages of traditional ownership, like access to low-cost leverage to make your money go farther, regular rental income and property appreciation, without getting locked into a 30-year mortgage.

Limited downside: Since investors are limited partners, their downside is limited to what they invest.

Professional Management: Investors benefit from expert management that handles all property-related tasks, like leasing, rent collection, paperwork, and maintenance.

Regulated: Guiker is fully regulated and subject to Canadian Securities laws. Before you invest, make sure to double-check!

Guiker created Propsharing as a way for more people to live the way they want to without missing out on the opportunity to build wealth in real estate.

TL;DR

Full Ownership:

Own property outright for personal use or rental.

Benefits: Long-term appreciation, rental income.

Trade-off: High upfront costs, lack of flexibility, liability, day-to-day management

Leverage in Real Estate:

Use of mortgages to buy property with less initial capital.

Attractive due to the potential for high returns on investment.

Risks: Debt commitment, fluctuating interest rates, and market volatility.

REITs (Real Estate Investment Trusts):

Invest in diversified real estate portfolios without owning property directly.

More accessible, with less hands-on involvement.

Downsides: Lack of individual asset transparency, and limited control over investments.

Propsharing with Guiker:

Properties are divided into shares; investors buy a part of a property much like stocks.

Combines the benefits of direct ownership (transparency, leverage, regular income) with stock investment (access, flexibility).

Professionally managed and regulated.

Lowers the barriers to real estate investing, broadens market access, offers income through dividends, and limits the downside risk to the amount invested.

Ready to explore the potential of real estate investment with Propsharing? Check it out on Guiker today and discover how you can start building your property portfolio.

* Disclaimer: Guiker provides information for educational purposes only and does not offer investment advice. Individuals are responsible for their own investment decisions and should consult a qualified financial advisor before making any investment choices.